|

* Information contained in this news release is current as of its date of announcement. Be aware that information contained herein is subject to change without notice. |

Full-Fledged Launch of Venture Co-creation Department Aimed at Creating New Industries

Established “31VENTURES Global Innovation Fund I” with JPY5 Billion

February 23, 2016

Mitsui Fudosan Co., Ltd.

Mitsui Fudosan Co., Ltd. will enhance its efforts in co-creation with startups for the ultimate goal to create new industries both to strengthen Mitsui Fudosan’s business and to expand the scope of its operations. We will provide fully integrated venture capital services, “Finance,” “Support” and “Community,” for ambitious startups.

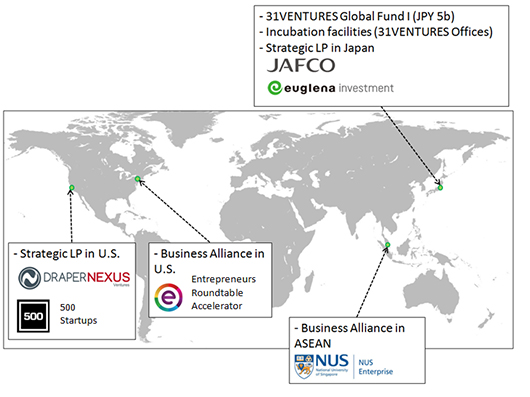

With regards to the first pillar, “Finance,” We will implement agile investment decisions in startups and build up a global investment network through strategic LP investments. We established our first corporate venture capital fund, “31VENTURES Global Innovation Fund I,” jointly operated with Global Brain Corporation (Global Brain), one of Japan’s largest venture capitalists having abundant experience in the venture capital field. We will also make strategic LP investments in venture capital funds globally to enrich the deal sources of the fund.

In terms of the “Support,” we will provide hands-on support that encompass every field. We will support all areas required for the growth of startups together with professional partner companies, such as law firms, accounting firms and consultants, to enable startups to succeed in their businesses. Moreover, by utilizing Mitsui Fudosan’s client network, support appropriate for the expansion stage such as development of sales channels will be provided. In view of establishing our global supportive network, we have launched collaborative business alliances with premier startup accelerators and incubators in a number of countries.

As for “Community,” Mitsui Fudosan will expand the line-up of its “31VENTURES Offices” that keep pace with the growth speed of startups. In addition, we will create an creative community where startups in various stages develop new businesses.

In the Venture Co-creation, we will achieve the creation of new industries together with startups through the business network of the Mitsui Fudosan Group which provides business and lifestyle solutions around the globe.

Details of the Three Pillars of Mitsui Fudosan’s 31VENTURES

“Finance”: CVC Fund and LP Investments

- Mitsui Fudosan’s first corporate venture capital fund

Mitsui Fudosan established the corporate venture capital fund, “31VENTURES Global Innovation Fund I” jointly with Global Brain, in order to build an investment platform for speedy investments that targets promising startups across the globe.

Fund Overview

| Name |

31VENTURES Global Innovation Fund I |

| Fund Manager |

Global Brain Corporation |

| Fund Size |

JPY5 billion |

| Fund Term |

10 years |

| Investment Stages |

Series A and thereafter including some pre-Series A investments |

| Covered Regions |

Japan, the United States, Europe, Israel, and Asian Countries |

| Targeted Industries |

All sectors other than biotechnology and pharmaceuticals |

| Priority Investment Focus |

Real estate, IoT, security, energy and green-tech, sharing economy, fin-tech and e-commerce, robotics, and life sciences |

| Investment Objectives |

To create new industries with invested startups through “triangle open innovations” among those startups, Global Brain, and Mitsui Fudosan. |

| Feature |

In light of the latest trend in startups, “connected” is an essential notion to realize entrepreneurs’ business ideas. As Japan’s top real estate developer, we can provide “real estate” to startups where they can achieve “connecting to real,” such as demonstration experiments in our assets.

|

- Strategic LP Investment in Venture Capital Funds

For the purpose of reaching startups in global, we will make strategic investments in venture capital funds. We have already realized investments in two Japanese venture capital funds. In last January, we made two strategic LP investments in a fund formed by “500 Startups,” a global venture capital seed fund and largest accelerator in the world, and a fund formed by “Draper Nexus Ventures,” a member of Draper Venture Network, a global alliance of independent venture capital firms. The firms are gathered by Tim Draper, the founder of DFJ, the top venture capital firm in the United States. We will continuously implement strategic LP investments in venture capital funds in wide areas around the world in order to complement our corporate venture capital fund from geographical and industrial aspects.

· Details of Strategic LP Investments

LP investment in 500 Startups Fund 4

Purpose: Find startups in their seed stage centered on those in the US

LP investment in Draper Nexus Ventures Fund 2

Purpose: Discover startups in the US and Japan in their early stages

“Support”: Hands-on Support Encompassing Every Field

- Supporting Startups with Diversifed Third-party Experts

We will support all areas required for the growth of startups with the combination of third-party experts and our business resources. We will also establish “Community Managers” as a management consultation service for the startups so that they can concentrate on their businesses. Through daily communications with startups, Community Managers will support the needs of the startups swiftly, sometimes even ahead of the requests.

- Business Alliance with Global Accelerators and Incubators

We started business alliance with two premier players outside of Japan, as part of the measures to support global reach of the startups. With regard to the United States, we started business cooperation with “Entrepreneurs Roundtable Accelerator,” a seed accelerator based in New York that has an established reputation in programs for the development of startups. As for ASEAN countries, we implemented business alliance with “NUS Enterprise,” which aggregates and advances innovation and entrepreneurship at the National University of Singapore, Asia's leading university. We will continue our efforts to cooperate with other parties into the future.

“Community”: Provision of Business Fields and Formulation of a Community

- New integration of Offices for Startups under “31VENTURES Office”

We will integrate the operations and services of each facility and expand both the number of facilities and services as “31VENTURES Office.” “31VENTURES Office” will create spaces that realize “open innovation” among startups in all stages, across facilities.

- Establishing an Organization for“31VENTURES Club”

We will establish “31VENTURES Club in the second quarter of this year.” Our great customers, users of the co-working offices and tenants of our incubation office spaces, will be “31VENTURES members.” We will create a community where any market participants in startup ecosystem are willing to participate, which will ultimately accomplish “true open innovation.”

“31VENTURES” is a registered trademark under Mitsui Fudosan.

31VENTURES Global Network

|

|

|