31VENTURES Global Innovation Fund II Established with ¥8.5 Billion

Total Investment for Startups of ¥43.5 Billion

Aiming to realize real estate as a service, digital transformation and smart cities and unearth new business

September 16, 2020

Mitsui Fudosan Co., Ltd.

Tokyo, Japan, September 16, 2020 – Mitsui Fudosan Co., Ltd., a leading global real estate company headquartered in Tokyo, announced today that it has established an ¥8.5 billion corporate venture capital fund, “31VENTURES Global Innovation Fund II L.P.” (“CVC2”), jointly operated with Global Brain Corporation, one of Japan’s largest independent venture capitalists to strengthen its main business and further expand its business domain.

Key Points of the Press Release

- CVC2 was established with ¥8.5 billion as the successor to CVC1, which was established in 2015.

- CVC2’s mission is to strengthen real estate as a service, digital transformation and smart cities and to create businesses that differ from existing business categories.

- The total for CVC1, CVC2 and the growth business is ¥43.5 billion, among the largest in Japan for startup company investment.

Mitsui Fudosan’s Venture Co-creation Department (“31VENTURES”) established 31VENTURES Global Innovation Fund I (“CVC1,” ¥5 billion) in 2015 to strengthen the company’s main business and expand its business domain, and invested in approximately 40 startups in Japan and abroad in their early to later stages. CVC2 was established as the successor to CVC1 to increase the investment fund to ¥8.5 billion.

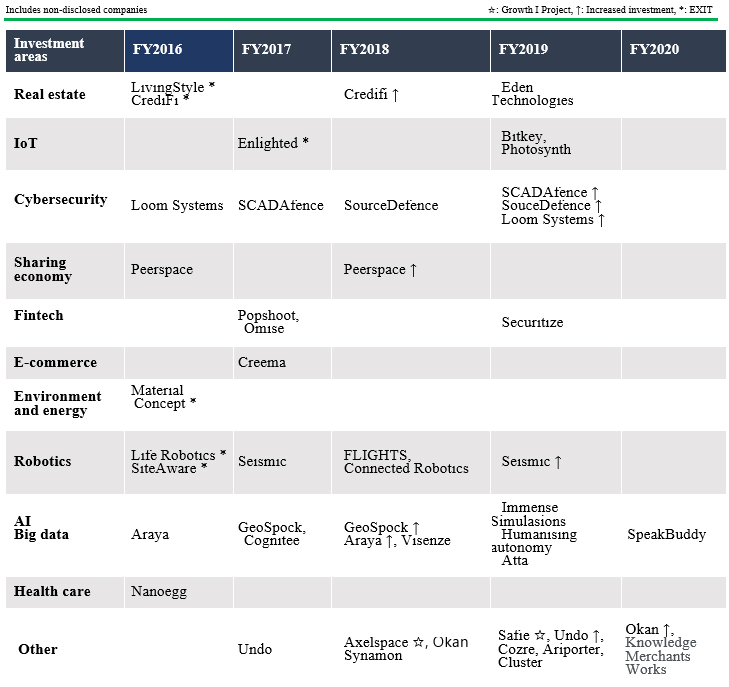

CVC2 will primarily consider startups that will strengthen the areas of real estate as a service, digital transformation and smart cities, and also startups that will create new businesses that differ from Mitsui Fudosan’s existing business categories. Priority areas for investment have been determined in anticipation of expansion of the Company’s business domains, and they include 15 categories with the new additions of mobility (MaaS, autonomous driving, fleet management, etc.), space, food products (food tech), agriculture (agritech), entertainment and others (Please refer to the following page). The size of the fund has been increased to ¥8.5 billion, and we plan to consider additional investment in our existing portfolio and to further strengthen business ties with individual companies.

The establishment of CVC2 (¥8.5 billion) combined with 2015 establishment of CVC1 (¥5 billion) and 2018 establishment of the growth stage startup Growth I Project (¥30 billion) brings the total to ¥43.5 billion, one of the largest startup investment funds for an operating company in Japan. Going forward, 31VENTURES intends to put even more focus on creating new industries through co-creation with startups.

■Fund Overview

| Name | 31VENTURES Global Innovation Fund II L.P. |

|---|---|

| Operators | Global Brain Corporation |

| Size of the fund | ¥8.5 billion |

| Operation term | 10 years |

| Investment stages | Startups from an early stage |

| Investment themes | Startups that provide products and services with elements of real estate as a service Startups that improve our business processes and contribute to digital transformation through, for example, digitalization and increasing business efficiency Startups with component technologies of smart cities Unearth new businesses differing from our existing business categories |

| Industry sectors targeted | All sectors |

| Priority areas | 1) Real estate tech, 2) IoT, 3) Cybersecurity, 4) Sharing economy, 5) E-commerce, 6) Fintech, 7) Environment and energy, 8) Robotics, 9) AI and big data, 10) Health care, 11) Mobility (MaaS, autonomous driving, fleet management, etc.), 12) Space, 13) Food products (food tech), 14) Agriculture (agritech), 15) Entertainment |

■“31VENTURES” Co-Creating with Startups [WEB]https://www.31ventures.jp/en/

Mitsui Fudosan is engaged in business innovation on the basis of its VISION 2025 announced in 2018, which includes the statement, “Harness technology to innovate the real estate business.” 31VENTURES promotes the creation of new industries through co-creation with startups via funding, startup office management and more. Since the Venture Co-creation Department was established in 2015, 31VENTURES has served as a bridge, creating more than 500 matches between startups and Mitsui Fudosan’s business divisions and facilitating approximately 100 verification tests and business alliances.

< Main Alliances with Startups>

1) Photosynth—a cloud service for all keys

- Verification testing of Akerun Visitor Management System started at Nihonbashi Muromachi Mitsui Tower (2020)

- Official introduction of Akerun Room Access Management System at WORK STYLING (2018)

Press release for reference : https://www.mitsuifudosan.co.jp/corporate/news/2018/0405/index.html

2) SCADAfence—cybersecurity solution for industry

- Building management system verification testing conducted at mixed-use Mitsui Fudosan-owned facilities in the Tokyo metropolitan area (2019)

Press release for reference:https://www.mitsuifudosan.co.jp/corporate/news/2018/1012_01/index.html

3) ViSENZE—AI-based image recognition technology

List of Companies Receiving Investment (CVC1: 39 companies, Growth I Project: 2 companies)

Comment from Atsumi Kanaya, Executive Officer and General Manager of Venture Co-creation Department, Mitsui Fudosan

“Since the Venture Co-creation Department was launched in 2015, we have spent five years expanding our network here and abroad and making investments in several dozen Japanese and international startup companies. Our work though doesn’t stop at investment; we also steadily promote business alliances with the startups through conducting verification testing, deploying services and other initiatives. To continue and further accelerate startup investment going forward, we established CVC2 to increase the scale of funding and expand the range of our investment. With customer values and needs diversifying and COVID-19 changing how people live, the roles expected of the real estate industry are also expected to change. The Venture Co-creation Department will accelerate innovation in the real estate industry by serving as a bridge between startups and the Mitsui Fudosan Group.”

Comment from Yasuhiko Yurimoto, CEO and General Partner of Global Brain Corporation

“The CVC1 fund has invested in around 40 startups in Japan and abroad in their early to later stages with the goal of strengthening Mitsui Fudosan’s main business and expanding its business domain. More corporate venture capital funds have been established in recent years and the amount of investment from these funds has also increased, so the presence of CVC in startup investment has increased dramatically, with Mitsui Fudosan’s CVC funds driving this trend as one of its pioneers.

Additionally, with regard to global investment conditions, participation rates by corporate venture capital in VC rounds has been increasing even in places like the US, EU and China despite COVID-19. At the same time, change will accelerate and companies will have to speedily adapt after COVID-19. Open innovation and alliances with startups through corporate venture capital will become increasingly important to quickly making business reforms and launching new businesses.

The CVC2 fund will accelerate creation of new business by Mitsui Fudosan with an even greater sense of speed and also strengthen collaboration for boosting startup businesses.”

■Mitsui Fudosan Group’s Contribution to SDGs

https://www.mitsuifudosan.co.jp/corporate/esg_csr/

The Mitsui Fudosan Group aims for a society that enriches both people and the planet under the principles of coexistence in harmony with society, link diverse values and achieve a sustainable society, and advances business with an awareness of the environment (E), society (S) and governance (G), thus promoting ESG management. By further accelerating its ESG management, the Group will realize Society 5.0, which the Japanese government has been advocating, and contribute significantly to achieving the SDGs.

*The initiatives covered in this press release are contributing to four of the UN’s SDGs.

| Goal 8 | Decent Work and Economic Growth |

|---|---|

| Goal 9 | Industry, Innovation and Infrastructure |

| Goal 11 | Sustainable Cities and Communities |

| Goal 17 | Partnerships for the Goals |