About Us

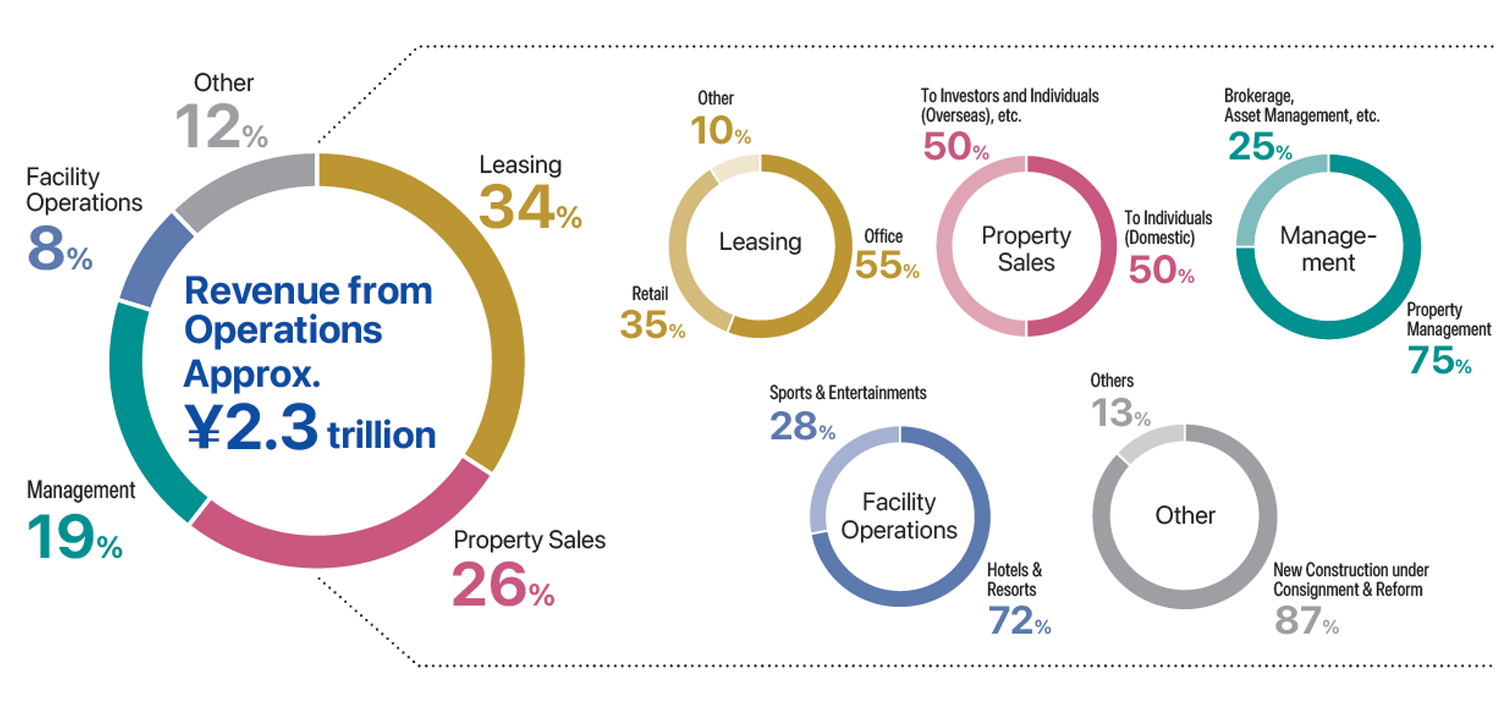

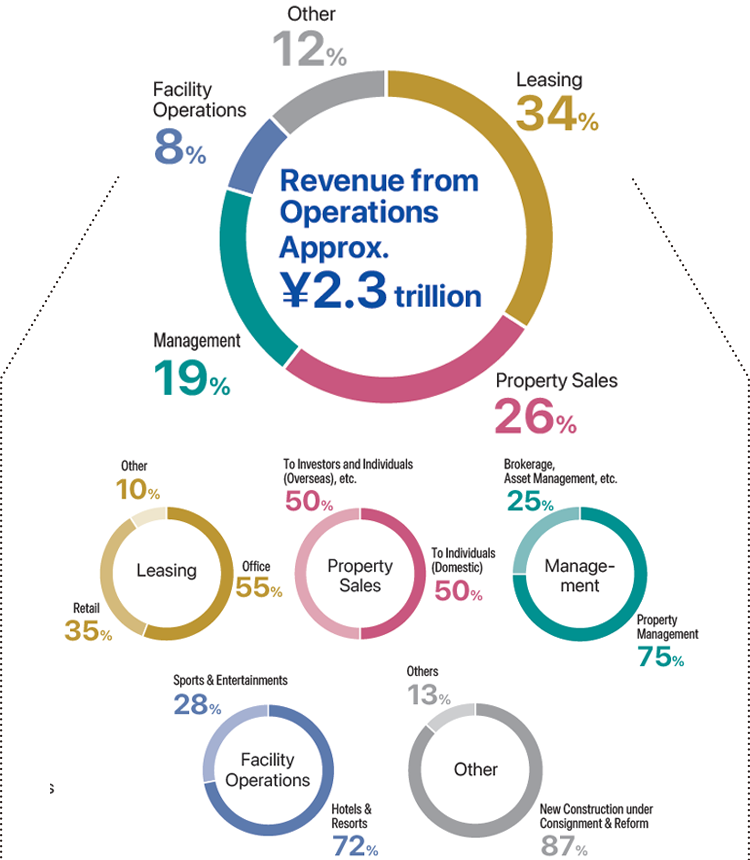

Our Business

OUR BUSINESS

-

Organization

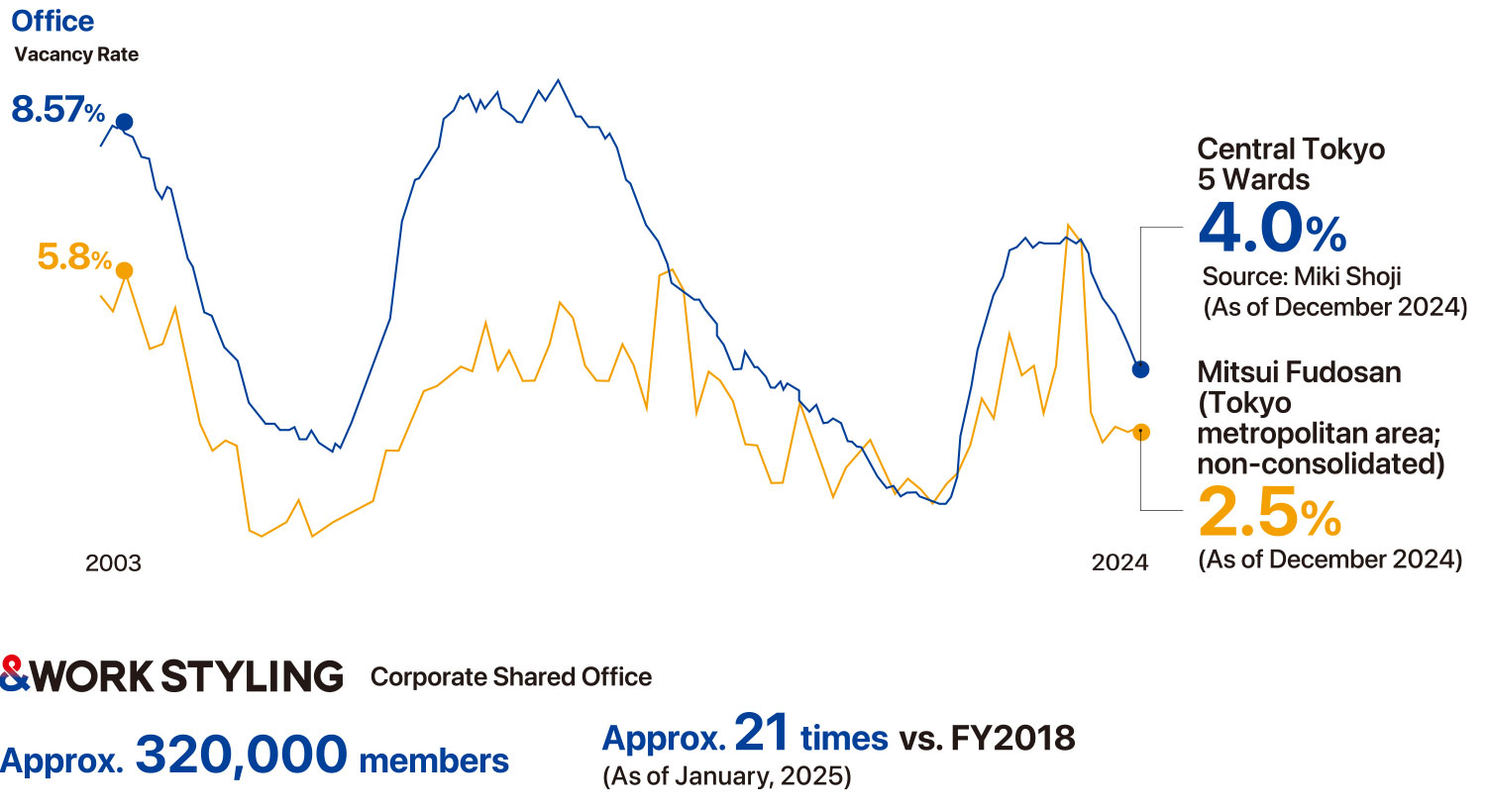

- Office Building Division

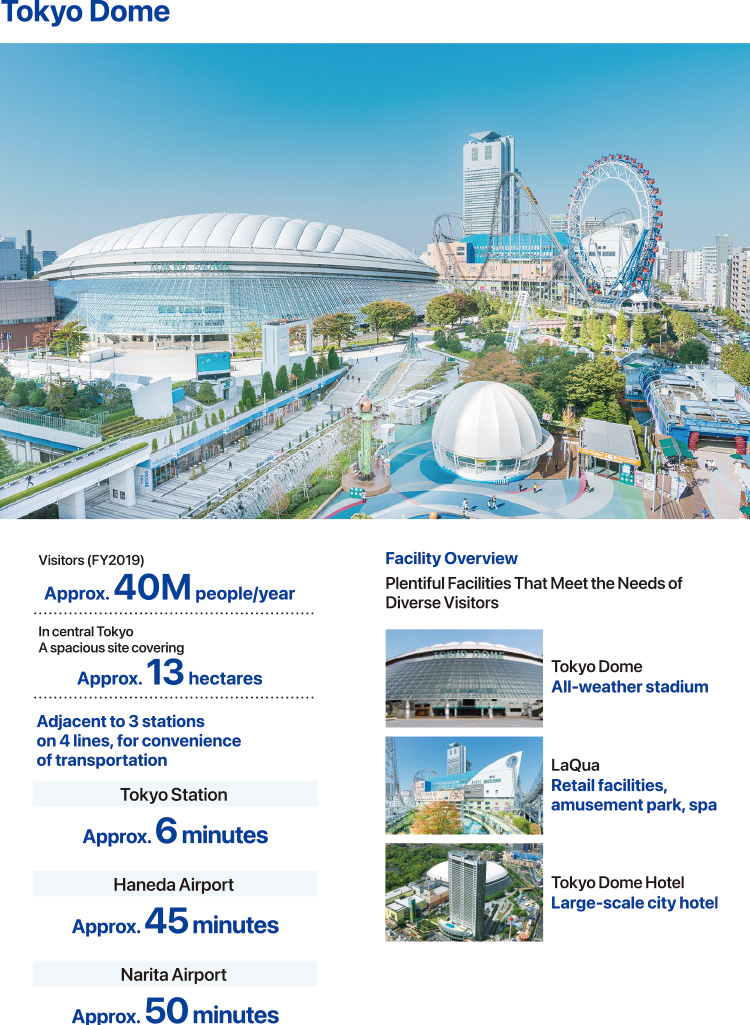

- Retail Properties, Sports and Entertainment Division

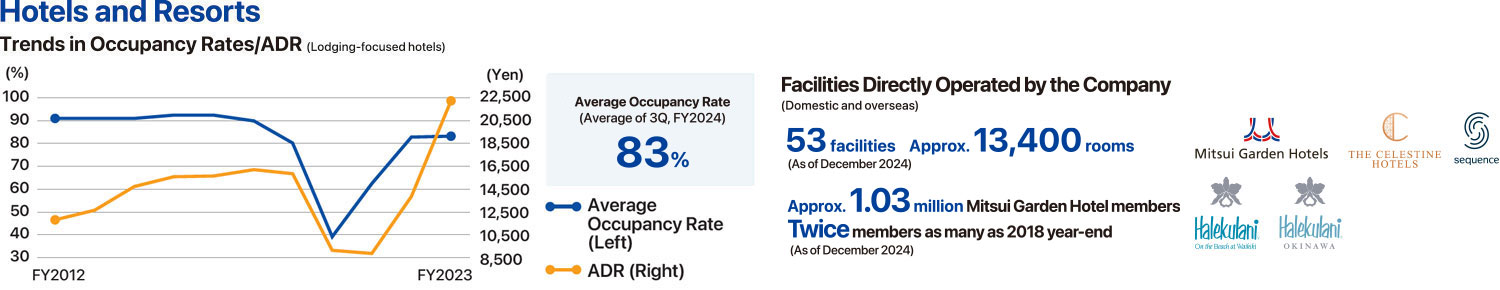

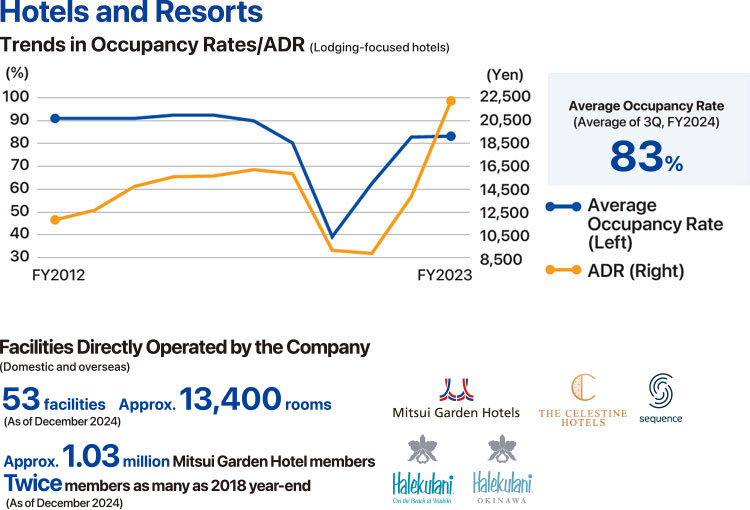

- Hotels and Resorts Division

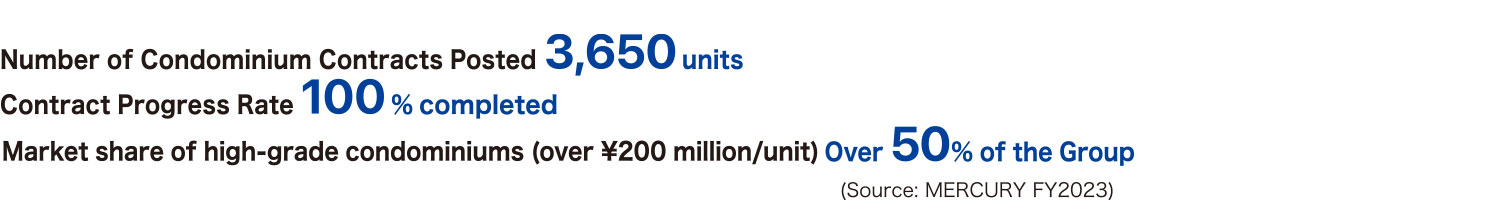

- Homes and Lifestyle Promoting Division

- Solution Partner Division

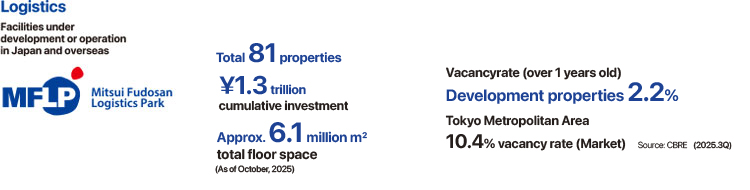

- Logistics Properties Business Division

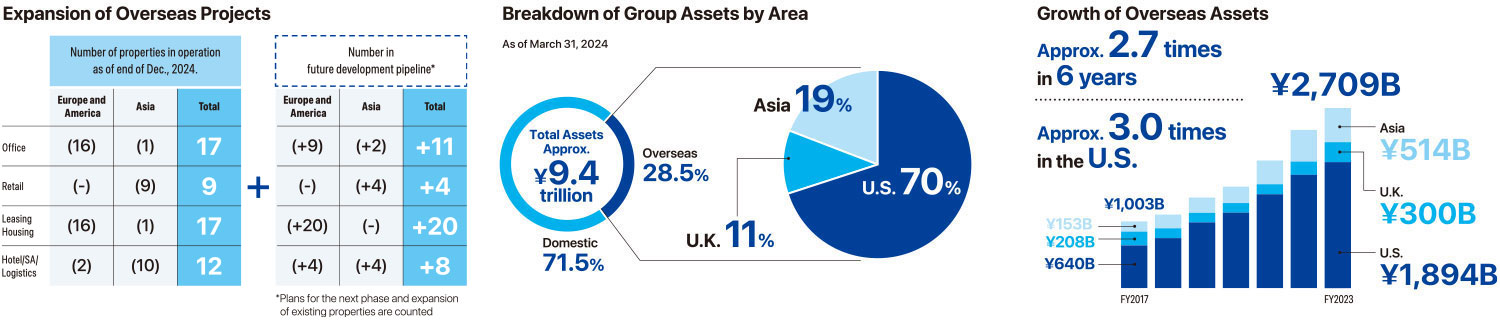

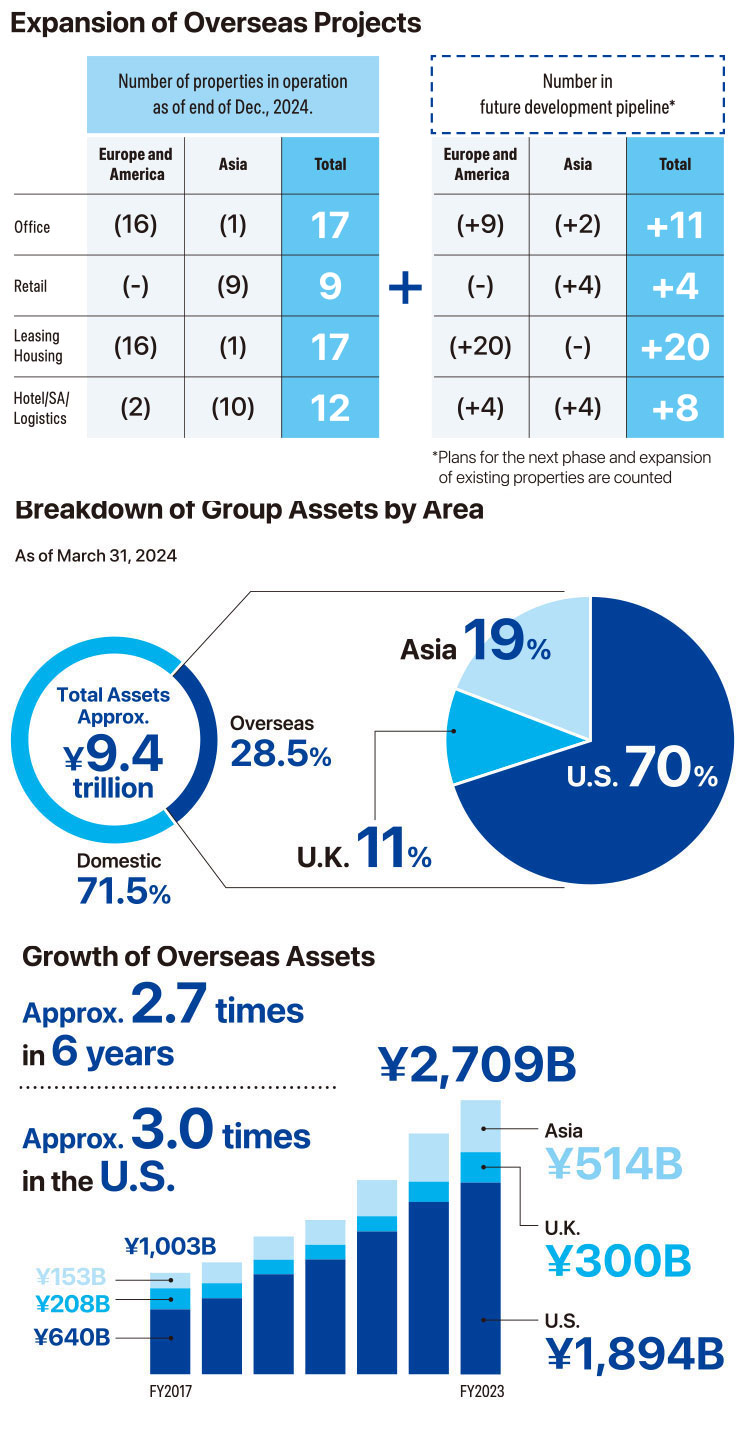

- International Division

- Digital Transformation Division

- Innovation Promoting Division

- Space & Environment Institute

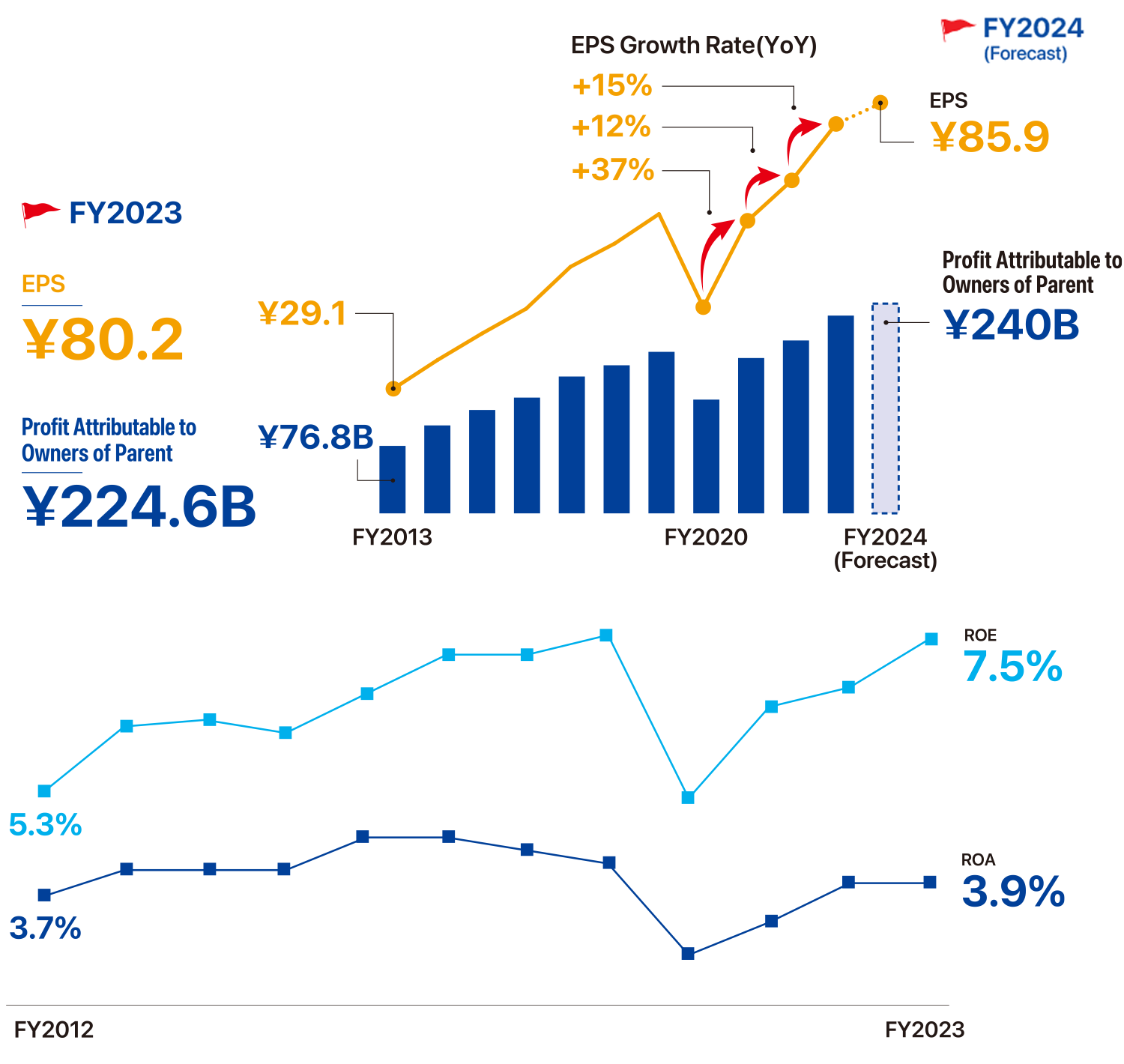

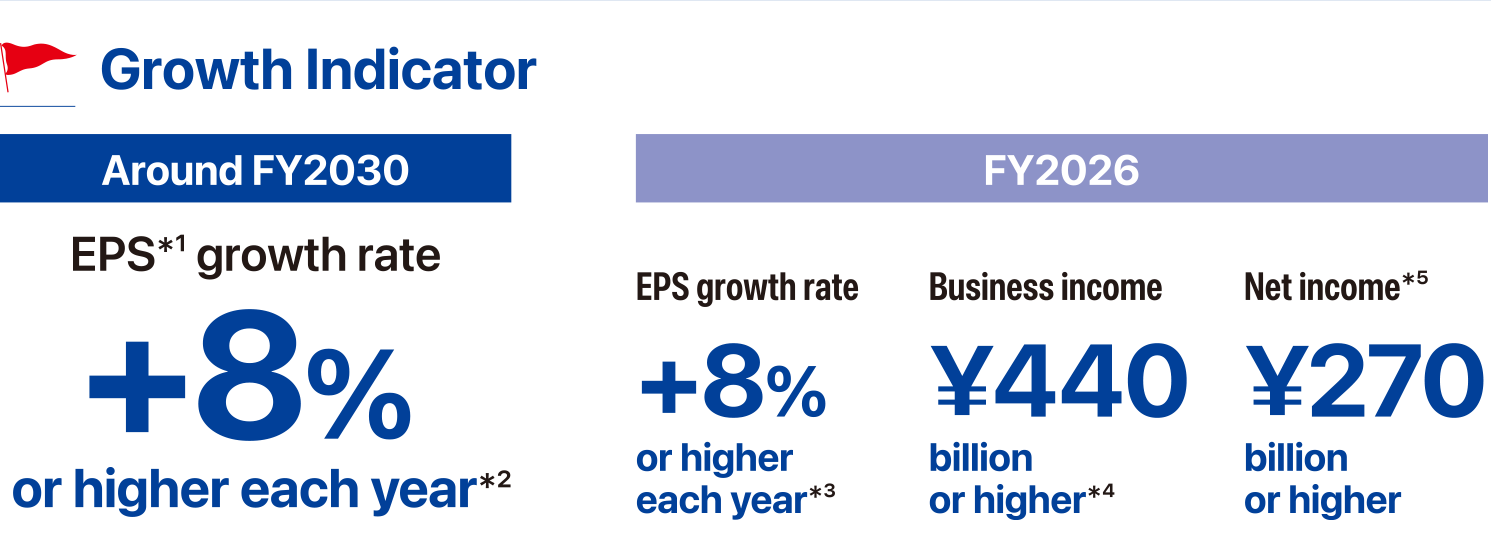

Investor Relations

IR

Sustainability / ESG

SUSTAINABILITY/ESG

- Our BusinessTOP

-

Our Organization

- Office Building Division

- Retail Properties, Sports and Entertainment Division

- Hotels and Resorts Division

- Homes and Lifestyle Promoting Division

- Solution Partner Division

- Logistics Properties Business Division

- International Division

- Digital Transformation Division

- Innovation Promoting Division

- Space & Environment Institute

- Neighborhood Creation

- Mitsui Fudosan and You