Corporate Governance System

The Group aims to create and maintain optimal corporate governance from the standpoint of improving the soundness, transparency and efficiency of management in order to gain the trust of its stakeholders.

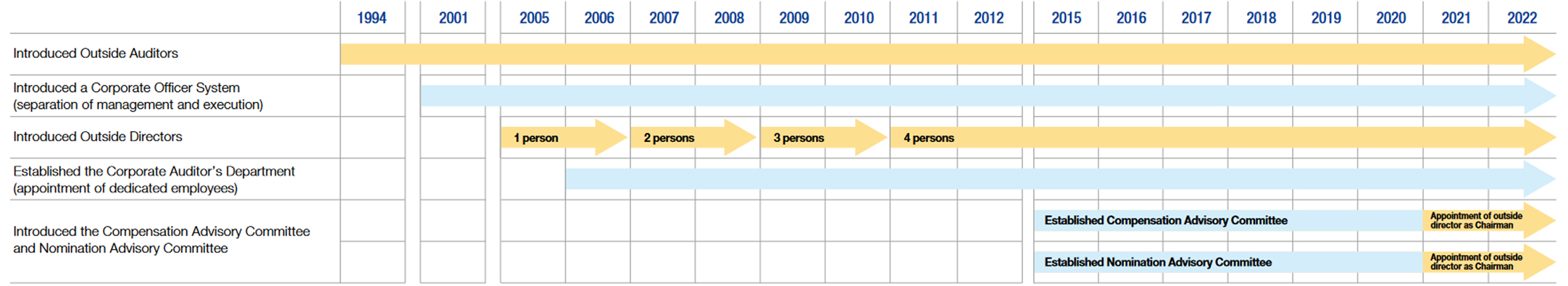

Mitsui Fudosan has both a Board of Directors and a Board of Corporate Auditors. To ensure transparency with respect to director compensation and appointments of directors and auditors, we maintain a Compensation Advisory Committee and a Nomination Advisory Committee. In addition, we have adopted a corporate officer system to enhance the soundness and efficiency of management by separating and strengthening management and executive functions. Mitsui Fudosan also invites and appoints outside directors in order to strengthen the oversight functions of the directors and enhance management transparency.

In addition, auditors conduct audits in a bid to evaluate the status of business execution by directors while coordinating with the Corporate Auditor’s Department, which serves as the internal audit department of the Company, as well as certified public accountants. Moreover, steps have been taken to put in place the Mitsui Fudosan Group Compliance Policy as well as a structure that will ensure that Group directors and employees engage in business activities in an appropriate manner.

Corporate Governance Structure

(1) Board of Directors

The Board of Directors, headed by Chairman Masanobu Komoda and comprising twelve members, including eight internal directors (Masanobu Komoda, Takashi Ueda, Takashi Yamamoto, Takayuki Miki, Yoshihiro Hirokawa. Shingo Suzuki, Makoto Tokuda, and Hisashi Osawa) and four outside directors (Tsunehiro Nakayama, Shinichiro Ito, Eriko Kawai, and Mami Indo), decides on issues material to Mitsui Fudosan and monitors the execution of business by managing directors.

Matters concerning the Board of Directors are as follows, set in accordance with the Company’s Articles of Incorporation and company rules such as those regarding the Board of Directors.

-

Role of the Board of Directors

The Board of Directors shall determine matters deemed vital to the Company, and oversee execution of duties by the directors.

-

Composition

The Board of Directors shall comprise no more than 15 directors.

-

Term of office for directors

The term of office for directors shall be from selection until the close of the General Shareholders' Meeting for the fiscal year ending within two years of selection.

-

Chairperson

The Board of Directors shall be chaired by the Chairman of the Board.

-

Decision-making process

Decisions made at the Board of Directors will require more than half of the directors to be in attendance, and will need the support of more than half of those in attendance.

-

Matters to be determined

The following matters shall be decided and reported.

(1) Matters related to shareholders’ meetings

(2) Matters related to directors

- Preliminary selection of director candidates

- The appointment and dismissal of representative directors

- The appointment and dismissal of executive directors

- Compensation, bonuses, and restricted stock compensation for directors

- Other important matters

(3) Matters related to the Company’s structure

(4) Important matters related to compliance, etc.

- Formulating a compliance promotion plan for the fiscal year

- Reporting on the results of compliance promotion activities implemented during the fiscal year

- Formulating an audit plan for the fiscal year

- Reporting on audit activities implemented during the fiscal year

- Evaluating internal controls concerning financial reporting during the fiscal year and formulating audit-related policy (J-SOX activities)

(5) Important matters related to personnel

- The appointment and dismissal of corporate officers and executive corporate officers

- The appointment and dismissal of key employees

- Compensation and bonuses for corporate officers, etc.

(6) Important matters related to finance and assets

(7) Other matters that are especially important in regard to managing the Company or executing duties

- Single-fiscal-year plans

- ESG plans

- Risk management reports

- Studies related to shares held as part of cross-shareholding policies

- Other important matters

【Director nomination policy】

Taking into account Company and Group management philosophies and strategies, candidates deemed suitable to be directors are nominated, after overall consideration of diversity-including personal qualifications, capabilities, views, and gender. At present, four of the seventeen directors and auditors are women (23.5%), and in the future we will work to ensure even greater diversity for the Board of Directors.

Managing Directors' Expertise, Experience (skills matrix), and Attendance at Board of Directors Meetings *1

| Attendance at Board of Directors Meetings (FY2022) |

Areas of expertise and experience | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Corporate management |

Treasury, accounting and finance |

Compliance and risk management |

Global | Technology and innovation |

ESG and Sustainability |

Urban development (real estate development, etc.) |

|||

| Masanobu Komoda |

Chairman of the Board | 12/12 | ● | ● | ● | ● | ● | ● | ● |

| Takashi Ueda | President and Chief Executive Officer | 12/12 | ● | ● | ● | ● | ● | ● | ● |

| Takashi Yamamoto |

Managing Director and Executive Vice President | 12/12 | ● | ● | ● | ● | ● | ||

| Takayuki Miki | Managing Director *2 | 10/12 | ● | ● | ● | ● | |||

| Yoshihiro Hirokawa | Managing Director | Newly appointed | ● | ● | ● | ● | |||

| Shingo Suzuki | Managing Director | Newly appointed | ● | ● | ● | ||||

| Makoto Tokuda | Managing Director | Newly appointed | ● | ● | ● | ||||

| Hisashi Osawa | Managing Director | Newly appointed | ● | ● | ● | ● | |||

| Tsunehiro Nakayama | Outside Director | 12/12 | ● | ● | ● | ● | ● | ||

| Shinichiro Ito | Outside Director | 12/12 | ● | ● | ● | ● | ● | ||

| Eriko Kawai | Outside Director | 12/12 | ● | ● | ● | ● | ● | ||

| Mami Indo | Outside Director | Newly appointed | ● | ● | ● | ● | ● | ||

(2) Compensation Advisory Committee

The Compensation Advisory Committee, headed by independent outside director Tsunehiro Nakayama as Chairman and comprising six members, including four independent outside directors (Tsunehiro Nakayama, Shinichiro Ito, Eriko Kawai, and Mami Indo), President and Chief Executive Officer Takashi Ueda, and one internal director (Makoto Tokuda), meets on matters pertaining to the compensation of managing directors. The committee met three times in fiscal 2022 and all committee members were in attendance on each occasion.

(3) Nomination Advisory Committee

The Nomination Advisory Committee, headed by independent outside director Tsunehiro Nakayama as Chairman and comprising six members, including four independent outside directors (Tsunehiro Nakayama, Shinichiro Ito, Eriko Kawai, and Mami Indo), President and Chief Executive Officer Takashi Ueda, and one internal director (Makoto Tokuda), meets on matters pertaining to the nomination of managing directors and corporate auditors, as well as the appointment and dismissal of managers. The committee met twice in fiscal 2022 and all committee members were in attendance on each occasion.

(4) Board of Corporate Auditors/Corporate Auditor's Department

The Board of Corporate Auditors, headed by senior corporate auditor Hiroyuki Ishigami, comprises two internal auditors (Hiroyuki Ishigami and Wataru Hamamoto) and three outside auditors (Yukimi Ozeki, Minoru Nakazato, and Mayo Mita), for a total of five auditors, and formulates auditing policies and determines assignments. It also receives reports and discusses material items on audits conducted according to these policies and assignments. Note that the Corporate Auditor’s Department has been established specifically to assist the corporate auditors with their work, and there are two dedicated employees. See “Governance-related Data” for details on the number of meetings held annually and the attendance status.

⇒ https://www.mitsuifudosan.co.jp/english/esg_csr/esg_data/governance/

(5) Corporate Officer System

Mitsui Fudosan has introduced a corporate officer system with the aim of creating a business execution framework that best suits its operating environment and activities. By promoting the separation and reinforcement of the management and executive functions, a role that was previously undertaken by company directors, the system enhances management soundness and efficiency. In addition, seeking to further reinforce the management of the Mitsui Fudosan Group, we have expanded the range of managers across the Group and introduced a Group corporate officer system, under which executives at Group companies have been given a status and mission similar to those of the corporate officers.

(6) Executive Management Committee

The Executive Management Committee, consisting of executive corporate officers, has been formed to deliberate and report on important matters related to business execution and supervises internal control and risk management. Full-time corporate auditors also attend meetings to stay informed of important decision-making processes and the status of business execution, and provide opinions as necessary.

(7) Financial Auditing

Mitsui Fudosan has concluded an auditing contract with KPMG AZSA LLC as its certified public accountant, which conducts audits. There is no shared interest between the auditor and the Company, nor between employees conducting operations for the auditor and the Company. The continuous auditing period of the auditor, the names and years of continuous auditing of the certified public accountants engaged in auditing in this fiscal year, and the composition of the assistants involved in auditing duties are as follows.

Continuous auditing period: 54 years

* This is the number of years since the Asahi Accounting Company, the predecessor of KPMG AZSA LLC, became an audit corporation.

Name of certified public accountants who have executed audits

Designated limited liability employee business executives: Yutaka Terasawa (1 year); Hiroyuki Ito (7 years); Hironori Hashizume (5 years)

* Number of years of continuous auditing are shown in parentheses.

Breakdown of assistants involved in financial auditing duties

Certified Public Accountants: 12; Passed CPA exam: 9; Others: 24

Strategy Planning Special Committee

Formulates and deliberates Group strategy and management plans and supervises business risk management at a Company and Group level, with the goal of discussing and managing the execution of those plans and other specific management issues.

Risk Management Special Committee

Formulates risk management policies and plans; tracks, evaluates and formulates responses and recurrence prevention measures for risk issues; and shares information as necessary throughout the Company and the Group for the purpose of comprehensively managing operational risks (disaster risk, system risk, administrative risk and compliance, etc.) in the conduct of operations throughout the Company and the Group.

ESG Promotion Committee

Formulates ideas and policies, sets goals, creates activity plans, manages progress and evaluates results related to ESG topics and the SDGs, with the goal of promoting action at a Company and Group level that contributes to ESG activities and the achievement of the SDGs, and initiatives aimed at decarbonization.