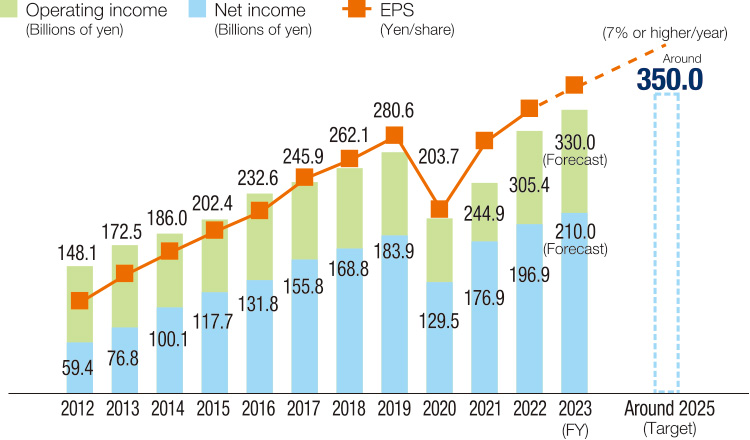

In fiscal 2022, we recorded operating income of ¥305.4 billion, up 24.7% year on year, and profit attributable to owners of parent (hereinafter referred to as net income) amounted to ¥196.9 billion, up 11.3% year on year. Revenue from operations, operating income, ordinary income and net income all surpassed initial forecasts and set new record highs.

For fiscal 2023, we are taking into account factors that include contributions to earnings and profit from office buildings completed in the previous fiscal year and newly opened retail facilities, improvements in earnings and profit through favorable housing sales and the sale of assets while maintaining an awareness of balance sheet control, and further recovery of earnings and profit at hotels, resorts and Tokyo Dome. As a result, we forecast revenue from operations of ¥2,300 billion, operating income of ¥330 billion, ordinary income of ¥245 billion, and net income of ¥210 billion, all of which are expected to be record highs. The net interest burden has increased significantly due to the impact of rapid interest rate hikes in the United States, but as the pace of the U.S. policy interest rate hikes has slowed, we expect that the rate of increase in our interest rate burden will likewise follow a gentle curve.

Regarding shareholder returns, we plan to increase the annual dividend by ¥6 per share from the fiscal year ended March 31, 2023, to ¥68 per share.

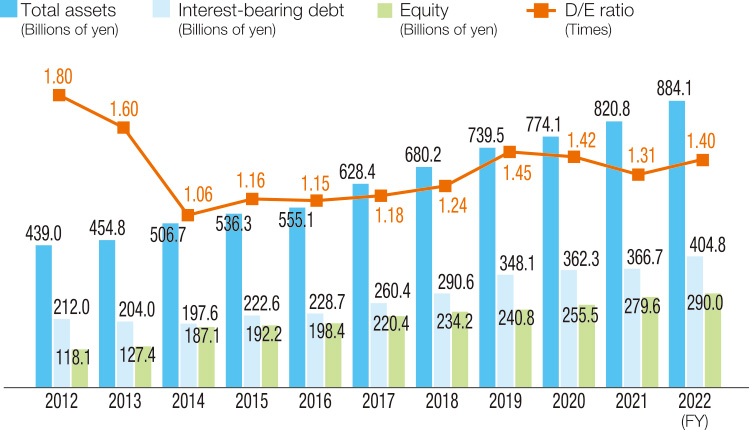

As the Group’s main businesses of real estate development and neighborhood creation–oriented businesses are characterized by the heavy long-term use of the balance sheet, balance sheet control from a medium- to long-term perspective is extremely important to achieve future earnings and profit growth and improve efficiency. Specifically, we take a 5–10 year perspective, combining proactive growth investments with cost recovery through continuous asset replacement in a well-balanced manner. We manage the entire balance sheet from a high level, through measures such as maintaining financial soundness through appropriate management of outstanding interest-bearing debt and the debt/equity ratio.

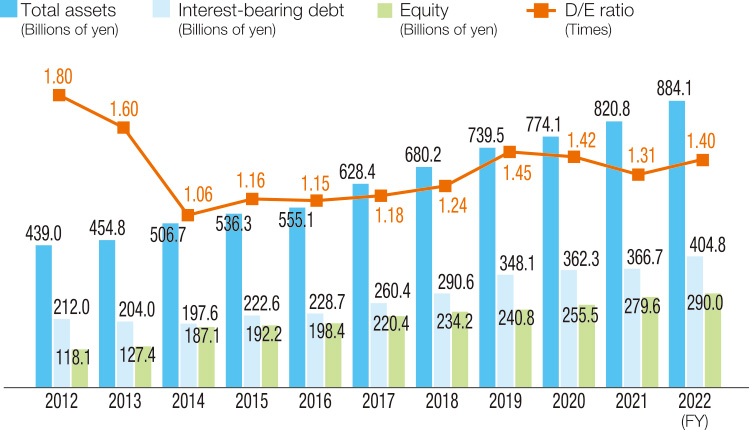

Comparing the balance sheet assets at the start of VISION 2025 (March 31, 2018) and March 31, 2023, total assets have increased approximately 1.4 times, from ¥6,284.7 billion to ¥8,841.3 billion. This was mainly due to the acquisition of excellent business opportunities and the favorable results of growth investments, such as the successive completion of large-scale, mixed-use projects—in Tokyo’s Hibiya, Nihonbashi and Yaesu districts as well as in New York—and the inclusion of the Tokyo Dome Group in the Company’s scope of consolidation as a subsidiary. While promoting growth investments, we have sold properties in recent years, including Shinjuku Mitsui Building, IIDABASHI GRAND BLOOM and TOYOSU BAYSIDE CROSS TOWER, to our sponsored REITs and have been making progress with asset replacement, such as the sale to investors of properties developed overseas, for example in the United States. With regard to investment securities, we have sold a total of ¥165.2 billion in shares under our policy of reducing strategic shareholdings as of the end of fiscal 2022 since fiscal 2018.

As a result of these efforts, we recognize that the current asset size has expanded more than expected, partly due to the impact of recent exchange rate fluctuations. However, since when the financial and real estate markets change is also a time to prepare high-quality assets that will be the source of future profit generation, we believe it is important to promote balance sheet control from a long-term perspective, without being influenced by the current short-term financial environment. While paying attention to the balance between future sustainable growth, efficiency and financial soundness, we would like to show an appropriate profit scale commensurate with the balance sheet scale and with a stronger awareness of ROE and ROA going forward. Likewise, we will continue to control those areas where management can make self-help efforts and, while not limiting asset replacement to real estate for sale, give consideration to the total, including fixed assets and marketable securities. Regarding the balance between debt and equity, we will consider the optimal cash allocation for growth investment, debt repayment and shareholder returns, based on such factors as ROE, the D/E ratio, and EPS growth rate.

Changes in Total Assets, Interest-Bearing Debt, Equity, and D/E Ratio

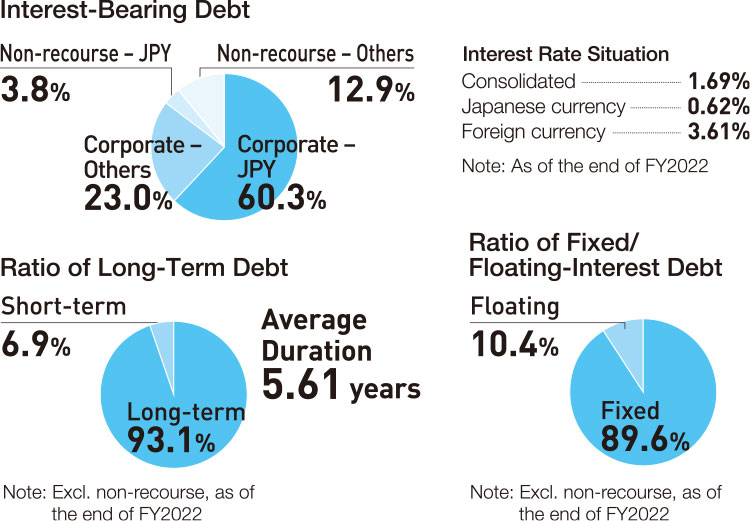

The external environment continues to be unstable, with inflation progressing around the world and concerns about future interest rate trends and economic recession, mainly in the United States. Under these circumstances, building and maintaining a sound financial position is important for the stable continuation of business. For this purpose, as a rule of thumb the Group manages its D/E ratio at a level of about 1.2–1.5. At the same time, to reduce risks related to financial market volatility while property development projects are under way, we are taking measures such as raising the ratio of fixed interest rate borrowings and long-term borrowings, staggering repayment periods, and maintaining our credit rating, (however, for new, dollar-denominated borrowings that are exposed to high interest rate risk and for the refinancing of existing floating interest rate borrowings, borrowings with floating interest rates or fixed interest rates with short maturities will be used in combination to respond to interest rate declines in the near future). We have also secured commitment lines totaling ¥400 billion to maintain liquidity for emergencies. As part of funding actions in the Group Action Plan to Realize a Decarbonized Society that we formulated in the autumn two years ago, we issued green bonds of ¥130 billion in May this year, following on from July last year the largest amount ever issued by a domestic real estate company. As such we are striving to diversify funding sources as well. In addition, to prepare for exchange rate fluctuations, we work to offset and reduce risks by using natural hedges, mainly in overseas businesses via the procurement of funds in local currencies.

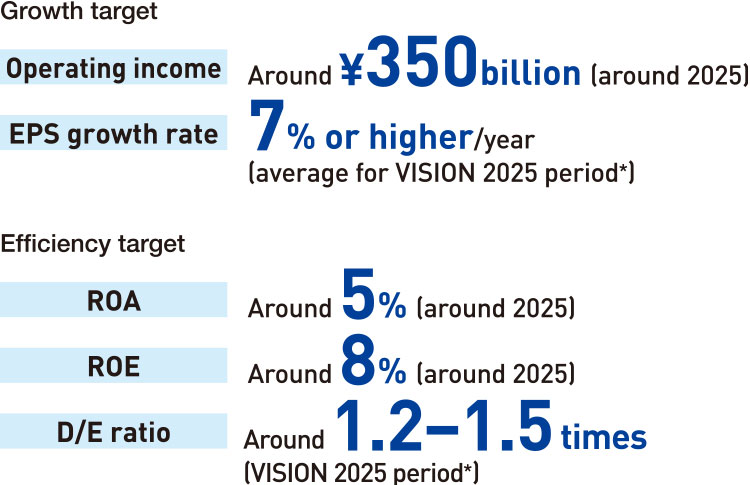

The Group’s medium- to long-term growth targets are operating income of about ¥350 billion (around 2025) and an EPS growth rate of 7% or more (average up to 2025), and its efficiency targets are ROA of around 5% and ROE of around 8% (both around 2025).

Of these, if the gain on sale of fixed assets (extraordinary income) expected this fiscal year is factored into the operating income target of ¥330 billion for fiscal 2023, I believe the operating income target is within sight of being achieved ahead of schedule. In the meantime, I also believe that there are still issues to be addressed in terms of improving efficiency. We are currently discussing how to improve efficiency with the goal of formulating the next long-term vision.

The Group is strongly aware of growth not only in the top line (revenue from operations) but also in the bottom line (net income).

Toward the realization of future earnings and profit growth and to improve efficiency based on our long-term financial strategy of staying abreast of the real estate cycle and interest rate trends, in addition to carefully selecting investments with an awareness of collected cash flow, we will continue to achieve returns that exceed the cost of capital by promoting balance sheet control with a focus on growth and efficiency. Through dialogue with investors and the enhancement of disclosure information, I will reflect the opinions of our investors in our management as we strive to reduce capital costs and further increase corporate value.

Outlook