~A Measure to Accelerate the Mitsui Fudosan Group’s Promotion of ESG Management~

Mitsui Fudosan to Issue Green Bond

July 30, 2019

Mitsui Fudosan Co., Ltd.

Mitsui Fudosan Co., Ltd., a leading global real estate company headquartered in Tokyo, announced today that it would issue a green bond*1 in September 2019 (“bond issue”) for refinancing of funds to acquire reserved floors in Nihonbashi Muromachi Mitsui Tower completed in March 2019 in the A Zone of Nihonbashi Muromachi 3rd District Project (Type 1 Urban Area Redevelopment Project) in Muromachi 3-Chome, Chuo-ku, Tokyo. Accordingly, Mitsui Fudosan submitted an amended shelf registration statement for the bond issue in Japan to the Kanto Local Finance Bureau on July 30, 2019.

*1 Bonds issued solely for the financing of Green Projects that have the effect of improving the environment

1. Purpose and background of bond issue

The Mitsui Fudosan Group, guided by the principles symbolized in the “![]() ” logo, seeks to coexist in society, link diverse values and achieve a sustainable society to help establish a society that enriches people and the planet. Based on the [

” logo, seeks to coexist in society, link diverse values and achieve a sustainable society to help establish a society that enriches people and the planet. Based on the [ ![]() ] philosophy, the Group has promoted ESG management, i.e., running a business mindful of the environment (E), society (S), and governance (G).

] philosophy, the Group has promoted ESG management, i.e., running a business mindful of the environment (E), society (S), and governance (G).

In the “VISION 2025” group vision formulated in the previous fiscal year, the Group’s top priority was formulated to achieve a sustainable society through neighborhood creation, setting the following six specific goals. These goals reflect the Mitsui Fudosan Group’s commitment to further accelerating ESG management.

- Establish ultra-smart societies by creating neighborhoods

- Achieve a society where a diverse workforce can thrive

- Achieve health, safety, and security in people’s daily lives

- Create new industries through open innovation

- Reduce environmental impact and generate energy

- Continuously improve compliance and governance

The Mitsui Fudosan Group believes its efforts to turn these goals into reality can make a major contribution toward attaining the Society 5.0 vision and the United Nations’ Sustainable Development Goals (SDGs).

* Mitsui Fudosan’s ESG initiatives are described in the following page of the corporate website.

https://www.mitsuifudosan.co.jp/english/corporate/esg_csr/

The purpose of issuing green bonds is to inform a broad range of Mitsui Fudosan stakeholders about these policies, as well as inspire problem-solving activities to achieve the Group’s six priority goals and help to create a sustainable society.

Nihonbashi Muromachi Mitsui Tower was completed on March 28, 2019. A flagship project of Stage 2 of the Nihonbashi Revitalization Plan, it is a large-sale, mixed-use facility with the key concepts of industry creation, neighborhood creation, community cohesion, and renewal of an aqua metropolis. The Nihonbashi Smart Energy Project*2 will supply power and heat to the Nihonbashi Muromachi Mitsui Tower, saving energy and reducing CO2 emissions by effective utilization of energy, as well as providing disaster resilience.

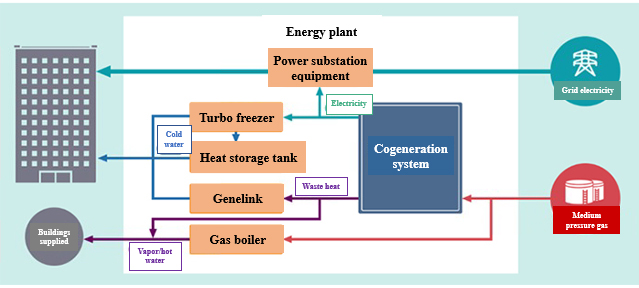

*2 An energy supply business provided by Mitsuifudosan TG Smart Energy K.K. jointly established by Mitsui Fudosan and Tokyo Gas Co., Ltd. Mitsuifudosan TG Smart Energy will install an area energy plant comprised of power generation and local area heating and air-conditioning facilities based on a high efficiency cogeneration system in Nihonbashi Muromachi Mitsui Tower. A first for Japan, the energy plant will supply electric power and heat not only to the local development zone, but to existing office and retail buildings in or near the Nihonbashi Muromachi area. The plant will supply energy in a highly efficient way by utilizing waste heat, highly efficient heat source equipment, and optimal energy management. It will also ensure stable energy supply in a disaster by power generation through the use of medium pressure gas pipes with excellent earthquake resistance and multiplexing power sources by grid electricity.

Conceptual image of power and heat supply system

2. Outline of issue

| Maturity | Five years (planned) |

|---|---|

| Amount of issue | ¥50 billion (planned) |

| Date of issue | September 2019 (planned) |

| Use of proceeds | The full amount will be used for refinancing of funds to acquire reserved floors in Nihonbashi Muromachi Mitsui Tower in the A Zone of Nihonbashi 3rd District Project (Type 1 Urban Area Redevelopment Project) in Muromachi 3-Chome, Chuo-ku, Tokyo. |

| Lead manager (planned) | Nomura Securities Co., Ltd., SMBC Nikko Securities Inc., Daiwa Securities Co., Ltd., Mizuho Securities Co., Ltd., Mitsubishi UFJ Morgan Stanley Securities Co., Ltd. | Green Bond Structuring Agent*3 | Nomura Securities Co., Ltd., SMBC Nikko Securities Inc. |

*3 Green bond structuring agents support the issue of green bonds by advising issuers on the establishment of a green bond framework and providing a second opinion.

3. Overview of Green Project

Overview of Nihonbashi Muromachi Mitsui Tower in the A Zone of Nihonbashi 3rd District Project (Type 1 Urban Area Redevelopment Project)

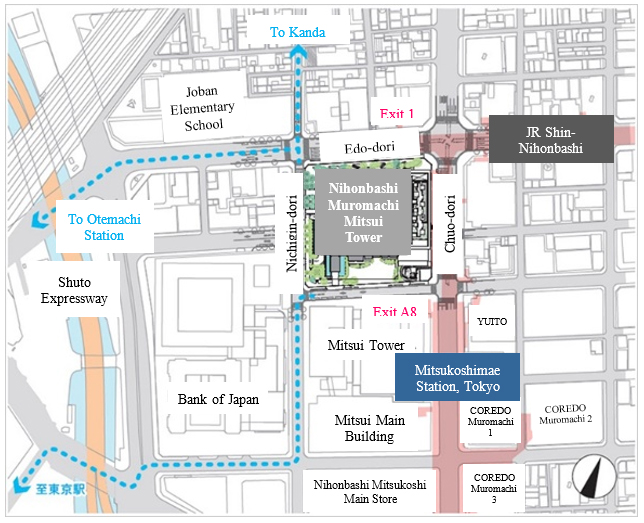

| Location | 3-2-1, Nihonbashi Muromachi, Chuo-ku, Tokyo | |

|---|---|---|

| Access | Direct access from the basement floor to Mitsukoshimae Station on the Tokyo Metro Ginza and Hanzomon lines Direct access from the basement floor to Shin-Nihombashi Station on the JR Yokosuka and Sobu lines 4 minutes on foot from Kanda Station on the JR Chuo, Yamanote and the Keihin Tohoku lines 9 minutes on foot from JR Tokyo Station for various JR lines |

|

| Site area | 11,480m2 | |

| Floor space | Approx. 168,000 m2 | |

| No. of floors/ height | 26 floors above ground, 3 floors below ground/Approx. 140 m | |

| Purpose | Offices, retail facilities, parking, etc. | |

| Design | Basic design | NIHON SEKKEI, INC. |

| Design execution | KAJIMA DESIGN (Kajima Corporation) | |

| Design architect | Pelli Clarke Pelli Architects Pelli Clarke Pelli Architects Japan, Inc. |

|

| Landscape design | Landscape Plus Ltd. | |

| Lighting design and plaza environment production | Uchihara Creative Lightning Design Inc. | |

| Builder | Joint project with Kajima Corporation, SHIMIZU CORPORATION and SATO KOGYO Co., Ltd. | |

| Schedule | Completion March 28, 2019 Grand Opening of retail facility COREDO Muromachi Terrace scheduled for September 27, 2019 |

|

Exterior of Nihonbashi Muromachi Mitsui Tower

Location of Nihonbashi Muromachi Mitsui Tower

Eligibility for Green Bond

Mitsui Fudosan established a Green Bond Framework in accordance with Green Bond Principles 2018 and Green Bond Guidelines 2017 to be able to issue a green bond.

A second opinion has been received from Rating and Investment Information, Inc. (R&I) stating that, based on the R&I Green Bond Assessment methodology *4, Mitsui Fudosan’s Green Bond Framework is in compliance with Green Bond Principles 2018 and Green Bond Guidelines 2017, and R&I (preliminarily) assigned a GA1 rating to the bond.

The third-party evaluation of the bond issue is eligible for subsidies under the Ministry of the Environment’s 2019 Financial Support Programme for Green Bond Issuance*5.

*4 A methodology using a five-scale evaluation criteria including items under the Green Bond Principles of the degree to which funds raised by the issue of green bonds are invested in a project that helps to solve environmental problems, which is monitored until the maturity date. In conjunction with the assessment, R&I may issue a second opinion regarding the issuer’s green bond framework, assessing it for compliance with Green Bond Principles and other rules.

*5 A program providing subsidies for any organizations that provide companies and local governments seeking to issue green bonds with external review and consultation services regarding establishment of the Green Bond Framework. The green bonds eligible for subsidies must use all proceeds on green projects, and satisfy all of the conditions below at the date of issue.

- A Green Project must meet one of the following criteria at the date of issue.

- Contributes mainly to domestic decarbonization (renewable energy, energy efficiency, etc.) Over half of the proceeds or number of projects must be domestic decarbonization projects

- Has high decarbonization effect and revitalization effect on local economy

Decarbonization effect: Those whose subsidy amount per ton of domestic CO2 reduction is less than the specified amount

Revitalization effect on local economy: Projects expected to contribute to revitalization of the local economy as part of an ordinance or plan determined by a municipality, or projects in which the municipality is expected to invest, etc.

- The issuer’s green bond framework must be reviewed by an external organization to confirm compliance with the Green Bond Guidelines prior to the issue.

- The bonds are not so-called green-wash bonds.

More information about obtaining a second option that the bond is compliant with the Green Bond Principles 2018 and Green Bond Guidelines 2017 can be found on the Rating and Investment Information, Inc. website as follows:

https://www.r-i.co.jp/en/rating/products/green_bond/index.html